All Categories

Featured

Table of Contents

Additional quantities are not ensured beyond the duration for which they are proclaimed. 4. Transforming some or every one of your financial savings to earnings advantages (described as "annuitization") is a long-term choice. Once income advantage settlements have started, you are not able to change to another choice. 5. TIAA Yearly Declaration (2014 2023), Page 4, Line 30.6.

These additional amounts are not guaranteed beyond the period for which they were declared. These calculations utilize the TIAA Typical "new cash" earnings price for a single life annuity (SLA) with a 10-year guarantee period at age 67 using TIAA's common payment method beginning income on March 1, 2024.

The outcome ($52,667) is preliminary earnings for Participant B in year 1 that is 32% greater than the preliminary income of Individual A ($40,000). Income prices for TIAA Traditional annuitizations are subject to change month-to-month. TIAA Standard Annuity income benefits include assured quantities plus added amounts as may be stated on a year-by-year basis by the TIAA Board of Trustees.

Deferred Income Annuity Rates

It is an arrangement that comes with an agreement describing particular guarantees. Set annuities guarantee a minimum price of interest while you conserve and, if you select lifetime earnings, a minimal monthly amount in retired life (fixed annuity income). Converting some or all of your financial savings to revenue benefits (referred to as "annuitization") is an irreversible decision

For its security, claims-paying capability and total financial toughness, TIAA belongs to among just three insurance policy teams in the USA to currently hold the highest score readily available to U.S. insurance firms from 3 of the 4 leading insurance business ranking companies: A.M. Ideal (A++ as of July 2024), Fitch, (AAA since May 2024; TIAA is rated greater than the U.S

Annuity Benefit

An ensured life time annuity is an economic product that assures to pay its owner revenue on a normal basis for the remainder of their life. Below's exactly how guaranteed life time annuities job and how to choose if one is ideal for you. An ensured life time annuity is a contract with an insurer that debenture income for the remainder of the customer's life in return for a swelling sum or a series of premiums.

Surefire life time annuities are not government guaranteed but might be covered by a state guaranty fund. Surefire life time annuities, in some cases called ensured lifetime earnings annuities, are contracts marketed by insurer. Their major selling factor is that the buyer will certainly never ever need to fret concerning running out of money as they age.

Instant Annuities

The buyer of a guaranteed lifetime annuity pays the insurance firm either a swelling sum of money (a single-premium annuity) or a series of premiums (a multiple-premium annuity). In return, the insurer agrees to provide the buyerand their partner or one more individual, when it comes to a joint and survivor annuitywith a surefire earnings forever, despite how much time they live.

That could happen, for instance, if the annuity owner passes away early right into the agreement.

In some feeling, a lifetime annuity is a wager between the insurance coverage business and the annuity's proprietor. The insurance firm will be the winner if the proprietor passes away prior to a certain point, while the proprietor will come out ahead if they surprise the insurer by living longer than anticipated.

, the proprietor can begin to get income right away.

Postponing revenue can allow the account to expand in value, resulting in higher payments than with a prompt annuity. Immediate annuities have no accumulation stage.

Annuity Risk

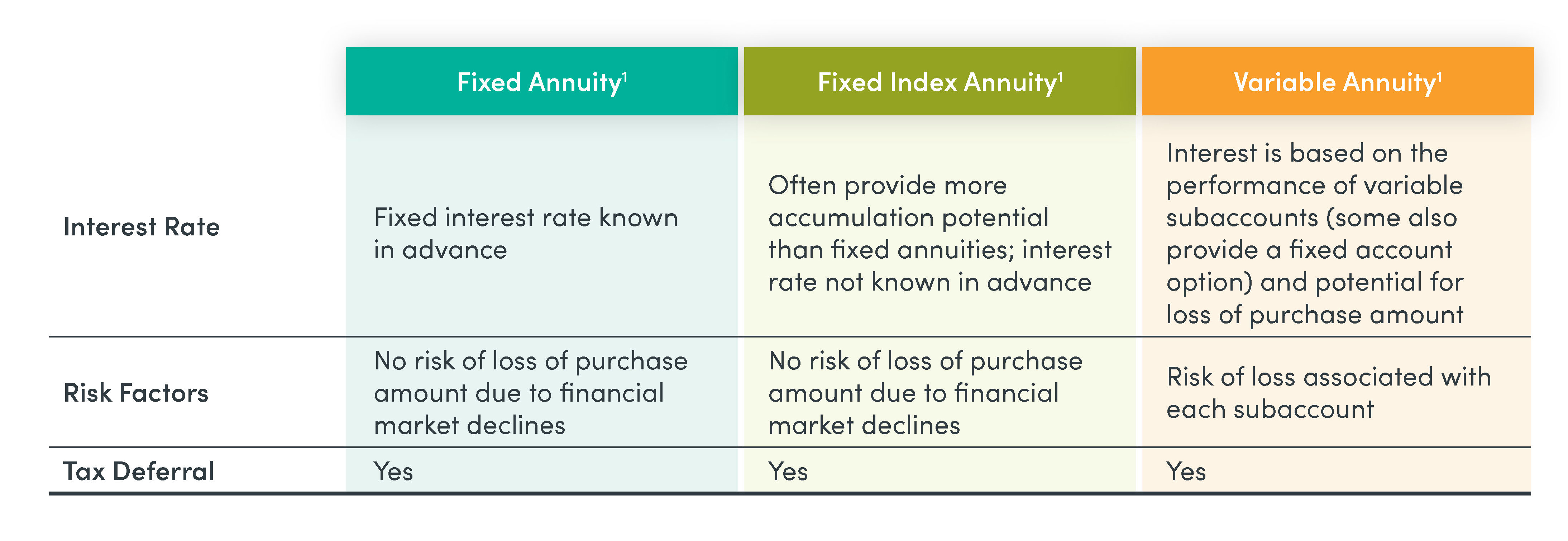

A variable annuity, on the other hand, will certainly pay a return based on the financial investments that the owner has picked for it, generally one or even more shared funds. When the payment phase begins, the owner might have a choice of obtaining set payments or variable settlements based on the recurring efficiency of their investments.

Since it is likely to have a longer payment stage, a joint and survivor annuity will commonly pay less each month (or various other time period) than a solitary life annuity.

Annuity Program

, or other investments. They also have some downsides.

An ensured life time annuity can offer revenue for the remainder of the proprietor's life. It can additionally be created to pay revenue to an enduring partner or various other person for the rest of their life. Surefire lifetime annuities can begin their payouts quickly or at some time in the future.

Annuities can be costly, however, and, relying on for how long the owner lives and obtains payments, might or may not show to be a great financial investment.

An immediate annuity lets you promptly transform a lump amount of cash into an ensured stream of revenue.

Your revenue is guaranteed by the company that releases the annuity. Make sure the company you purchase your annuity from is economically sound. New York Life has earned the highest possible ratings for monetary strength currently granted to United state

2 An income annuity earnings help protect assist the versus of threat your outlasting.

A fixed-rate annuity has a mentioned price of return and no loss of principal due to market slumps. In many cases, it allows the proprietor to earn greater passion than bonds, money markets, CDs and various other financial institution items. The financial investment expands tax-deferred, which means you will certainly not need to pay tax obligations on the interest till you withdraw cash from the annuity.

Guaranteed minimum rate of return for a certain duration. Your financial investment will certainly expand tax-deferred up until you take a withdrawal. There is no market threat with a repaired annuity. Your principal is safeguarded and guaranteed to collect at a set price. Set annuities give some liquidity, generally 10% of the agreement's built up value is offered penalty-free on a yearly basis if you more than 59, and some taken care of annuities permit you to take out the rate of interest on an annual basis.

Is An Annuity Worth It

Annuities are made to be lasting financial investments and regularly include charges such as earnings and death benefit cyclist charges and give up fees.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices Key Insights on What Is Variable Annuity Vs Fixed Annuity What Is Fixed Vs Variable Annuities? Advantages and Disadvantages of Different Retirement Plans Why Fixe

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works What Is Fixed Vs Variable Annuities? Pros and Cons of Various Financial Options Why Choosing the Right Financi

Highlighting the Key Features of Long-Term Investments Key Insights on Your Financial Future What Is Variable Annuity Vs Fixed Indexed Annuity? Advantages and Disadvantages of Fixed Vs Variable Annuit

More

Latest Posts